The ceramic tiles industry in Vietnam is growing rapidly, thanks to an increase in demand for construction materials, rise in disposable income, and a growing focus on interior design. In this article, we will look at the growth trends of the Vietnam ceramic tiles market, the impact of COVID-19 on the industry, and make forecasts for the coming years.

Introduction

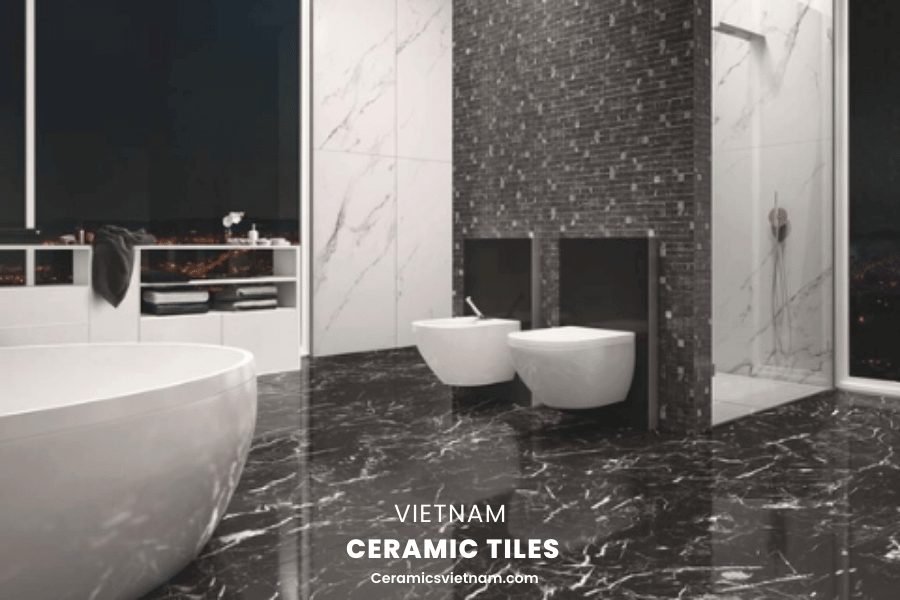

Ceramic tiles have a long history in Vietnam, dating back centuries. However, the ceramic tiles industry has seen significant growth in recent years due to various factors. Ceramic tiles have become an integral part of the construction industry in Vietnam, finding use in applications such as flooring, wall cladding, roofing, and more. The demand for ceramic tiles in the country has been on the rise, driven by an increase in construction activities, a growing focus on interior decoration, and rising disposable incomes. Another reason is the use of ceramic tiles in construction which has several advantages, including durability, low maintenance, and eco-friendliness. These features have made ceramic tiles a popular choice for construction materials in Vietnam. In this article, we will take a closer look at the Vietnam ceramic tiles market.

Market overview

The Vietnam ceramic tiles market has witnessed significant growth over the past few years and is expected to continue its growth trajectory in the coming years. According to market research, the Vietnam ceramic tiles market was valued at USD 4.8 billion in 2020, and it is projected to grow at a CAGR of 6.2% during the forecast period (2022-2027), reaching USD 7.1 billion by 2027.

The market growth can be attributed to various factors such as the increase in construction activities, particularly in the residential sector, due to rapid urbanization and infrastructure development in Vietnam. Moreover, the rise in disposable income has led to a growing trend of interior design, which has further fuelled the demand for ceramic tiles in the market.

The adoption of ceramic tiles as a construction material has also been driven by the advantages it offers, such as durability, scratch resistance, low maintenance, and eco-friendliness. As a result, ceramic tiles are being increasingly used in flooring, wall cladding, roofing, and other applications in residential, commercial, and industrial buildings.

Furthermore, the Vietnam ceramic tiles market is highly competitive, with several key players operating in the market. These players are focusing on expanding their product portfolios, increasing their production capacities, and enhancing their distribution channels to meet the growing demand for ceramic tiles in the market.

In brief, the Vietnam ceramic tiles market presents lucrative opportunities for both existing and new players in the market. The market is expected to benefit from the growth of the real estate sector, the trend of sustainable construction, and the increasing demand for construction materials and interior decoration in the coming years.

The significant growth of Vietnam ceramic tiles market

Market dynamics

Drivers

The Vietnam ceramic tiles market has been driven by several key drivers in recent years. One of the primary drivers is the increase in construction activities due to rapid urbanization and infrastructure development in the country. As the population of Vietnam continues to grow, the demand for new housing, commercial buildings, and public infrastructure has risen significantly. This has led to a surge in demand for construction materials such as ceramic tiles, which are widely used in various applications such as flooring, wall cladding, and roofing.

Another important driver of the market is the rise in disposable income, which has led to an increase in spending on home decoration and renovation. As people’s incomes have increased, they have become more conscious of the aesthetics of their homes and the need to create a comfortable and visually appealing environment. Ceramic tiles are a popular choice for interior decoration due to their durability, versatility, and aesthetic appeal. As a result, there has been a growing demand for ceramic tiles in the market.

Last but not least, the adoption of ceramic tiles as a construction material has also been driven by the advantages it offers, such as its low maintenance, scratch resistance, and eco-friendliness. These advantages have made ceramic tiles a preferred choice for both residential and commercial building projects.

It can be proven that the drivers of the Vietnam ceramic tiles market reflect the growing demand for construction materials and the increasing trend of interior design in the country. As these drivers continue to fuel the growth of the market, it is expected to witness significant expansion in the coming years.

The Vietnam ceramic tiles market has been driven by several key drivers

Restraints

While the Vietnam ceramic tiles market has been growing rapidly, there are also some restraints that need to be considered. One of the primary restraints is the high cost of production associated with ceramic tiles. The production process requires a significant amount of energy and resources, which results in higher production costs. As a result, the final price of ceramic tiles is relatively high, making them less affordable for some consumers. This has limited the market potential of ceramic tiles in Vietnam, especially among price-sensitive consumers.

The availability of substitutes such as vinyl and wooden flooring is an crucial restraint of the market dynamics. These products offer similar benefits as ceramic tiles, such as durability, aesthetic appeal, and ease of maintenance. Furthermore, they are often less expensive than ceramic tiles, making them a more affordable option for many consumers. This has created a competitive market environment, where ceramic tile manufacturers need to offer competitive pricing to remain competitive in the market.

In addition, the COVID-19 pandemic has also impacted the market dynamics of the Vietnam ceramic tiles market, leading to a slowdown in construction activities and a decrease in demand for ceramic tiles. While the market has started to recover, the impact of the pandemic has resulted in a more cautious approach among consumers, and this has impacted the growth of the market in the short term.

Overall, the restraints of the Vietnam ceramic tiles market reflect the need for manufacturers to remain competitive by offering affordable pricing, product innovation, and marketing strategies to increase consumer awareness and demand for ceramic tiles.

Some restraints on the Vietnam ceramic tiles market

Opportunities

The Vietnam ceramic tiles market presents several opportunities that can drive its growth in the coming years. One of the key opportunities is the growth of the real estate sector in the country. Vietnam has been experiencing rapid urbanization, and this has led to an increase in demand for housing. As a result, the real estate sector has been growing, and this presents an opportunity for the ceramic tiles market. Ceramic tiles are widely used in residential and commercial construction, and the growth of the real estate sector is expected to drive demand for the product.

Another important opportunity for the market is the growing trend of sustainable construction. Ceramic tiles are a sustainable and eco-friendly option for construction, as they are made from natural materials and can be recycled at the end of their useful life. This has led to an increase in demand for the product, particularly among environmentally conscious consumers. As the trend of sustainable construction continues to grow, the demand for ceramic tiles is expected to rise further, providing a significant growth opportunity for manufacturers.

Moreover, the increasing trend of interior design and home renovation is also expected to drive the growth of the Vietnam ceramic tiles market. As more consumers become aware of the aesthetic and functional benefits of ceramic tiles, there is likely to be an increase in demand for the product in the market. This presents an opportunity for manufacturers to expand their product portfolios and offer a wider range of ceramic tiles to meet the growing demand.

In summary, the Vietnam ceramic tiles market is poised for significant growth due to the opportunities presented by the growing demand for sustainable construction materials, the expanding real estate sector, and the increasing trend of interior design and home renovation. Manufacturers who can effectively capitalize on these opportunities are likely to experience a surge in demand for their products, leading to overall market growth in the coming years.

The Vietnam ceramic tiles market presents several opportunities

COVID-19 impact on Vietnam Ceramic Tiles Market

The COVID-19 pandemic has had a significant impact on the Vietnam ceramic tiles market, causing short-term disruptions and challenges for manufacturers. The pandemic led to a decrease in demand for construction materials, including ceramic tiles, due to the restrictions on movement and shutdown of non-essential activities. As a result, ceramic tile manufacturers faced a reduction in production capacity and revenue.

Moreover, supply chain disruptions caused by the pandemic led to delays in delivery times and an increase in production costs, making it difficult for manufacturers to plan their production and inventory management. Despite these challenges, the market has shown resilience and is expected to recover and witness significant growth in the coming years.

The government’s stimulus measures to support the real estate and construction sectors have helped to boost demand for ceramic tiles in the market. Additionally, the growing trend of sustainable construction and the need for eco-friendly materials such as ceramic tiles has increased the demand for the product.

The adoption of digital technologies in the market, such as online sales channels and virtual showrooms, has also helped manufacturers maintain their business operations during the pandemic and reach out to customers effectively.

According to reports by ResearchAndMarkets, the Vietnam ceramic tiles market witnessed a decline in revenue in 2020 due to the pandemic, with a drop in demand for ceramic tiles in the short term. However, according the figure mentioned above, the market is expected to recover and grow at a compound annual growth rate of 6.2% during the forecast period from 2022 to 2027.

Reports by Ken Research also indicate that the government’s stimulus measures have boosted demand for ceramic tiles in the market. The market is expected to benefit from the trend of sustainable construction, which is expected to drive demand for eco-friendly materials such as ceramic tiles. Furthermore, reports by PR Newswire indicate that the adoption of digital technologies in the market has helped manufacturers maintain business operations during the pandemic and reach out to customers effectively.

While the COVID-19 pandemic has caused short-term disruptions and challenges for the Vietnam ceramic tiles market, the market is expected to recover and witness significant growth in the coming years. The expanding real estate sector, sustainable construction trends, and the growing demand for interior design and home renovation are expected to be the key drivers of growth in the market.

COVID-19 impact on Vietnam Ceramic Tiles Market

Market segmentation

By product type

The Vietnam ceramic tiles market can be segmented by product type into wall tiles and floor tiles. Wall tiles are used for interior and exterior walls, while floor tiles are used for flooring purposes.

Vietnam’s wall tiles market is a growing industry, driven by various factors such as increasing construction activities, rising disposable income, and the growing trend of interior design. Wall tiles are a crucial component of interior decoration, and the demand for wall tiles in Vietnam has been on the rise. Wall tiles come in various materials such as ceramic, porcelain, and glass, among others. Ceramic wall tiles are the most commonly used wall tiles in Vietnam due to their affordability, durability, and versatility. Porcelain wall tiles are also gaining popularity due to their strength and resistance to stains and scratches.

Floor tiles are also segmented into ceramic, porcelain, and vitrified tiles. Ceramic floor tiles are the most commonly used floor tiles in the market due to their affordability and durability. Porcelain floor tiles are also popular due to their high resistance to water, scratches, and stains. Vitrified floor tiles are less commonly used in the market due to their higher cost.

The market can also be segmented by application into residential and commercial. Residential applications include homes and apartments, while commercial applications include offices, hotels, hospitals, and retail stores.

Additionally, the market can be segmented by distribution channel into offline and online. Offline distribution channels include dealers, distributors, and retailers, while online distribution channels include e-commerce websites and online marketplaces.

Market segmentation by product type provides insight into the different types of ceramic tiles available in the market and their applications. Understanding the segmentation can help manufacturers tailor their product offerings and marketing strategies to target specific segments of the market.

Vietnam ceramic tiles market segmentation by product type – Wall tiles & Floor tiles

Vietnam ceramic tiles market segmentation by product type – Wall tiles & Floor tiles

By Application

The Vietnam ceramic tiles market can be segmented by application into residential and commercial. Residential applications include homes and apartments, while commercial applications include offices, hotels, hospitals, and retail stores.

Residential segment

The residential segment is one of the key application areas for ceramic tiles in the Vietnam market. The increasing demand for housing due to rapid urbanization has led to a growth in the residential sector, which in turn has driven the demand for construction materials such as ceramic tiles.

Ceramic tiles are a popular choice for residential flooring and wall covering due to their durability, easy maintenance, and aesthetic appeal. In addition, ceramic tiles are available in a variety of designs, colors, and sizes, making them suitable for different interior design styles.

The residential segment includes various sub-segments such as apartments, villas, and individual houses. Ceramic tiles are widely used in these sub-segments for flooring, wall covering, and even as roofing tiles. For example, ceramic tiles are often used for bathroom and kitchen flooring and wall covering, as well as for outdoor patios and balconies.

To cater to the growing demand from the residential segment, ceramic tile manufacturers are expanding their product portfolio, offering a wider range of designs and sizes suitable for different residential applications. In addition, manufacturers are also focusing on developing sustainable and eco-friendly ceramic tiles to cater to the growing trend of sustainable construction in the residential segment.

Tlhe residential segment is a key application area for ceramic tiles in the Vietnam market, driven by the increasing demand for housing and the popularity of ceramic tiles for flooring and wall covering in residential properties.

Vietnam ceramic tiles market segmentation by application – Residential segment

Commercial segment

The commercial segment is another key application area for ceramic tiles in the Vietnam market. The commercial segment includes various sub-segments such as offices, hotels, restaurants, and retail spaces.

Ceramic tiles are a popular choice for commercial flooring and wall covering due to their durability, easy maintenance, and aesthetic appeal. In addition, ceramic tiles are available in a variety of designs, colors, and sizes, making them suitable for different commercial interior design styles.

The commercial segment requires ceramic tiles with specific properties such as high slip resistance and low porosity to withstand heavy foot traffic and maintain hygiene. Ceramic tiles are also used for specialized applications such as swimming pool tiling, laboratory flooring, and hospital walls and floors.

To cater to the diverse needs of the commercial segment, ceramic tile manufacturers offer specialized products such as anti-slip tiles, acid-resistant tiles, and germ-resistant tiles. In addition, manufacturers also provide customized solutions for specific commercial applications.

The commercial segment is a growing market in Vietnam, driven by the increasing number of commercial projects such as office buildings, hotels, and shopping malls. To capitalize on this growth, ceramic tile manufacturers are expanding their product portfolio and investing in research and development to offer innovative and specialized products for the commercial segment.

The commercial segment is a significant application area for ceramic tiles in the Vietnam market, driven by the growing demand for durable and aesthetically appealing flooring and wall covering solutions for commercial spaces.

Moreover, market segmentation by application can help manufacturers identify and target specific segments of the market with tailored product offerings and marketing strategies. The growing demand for eco-friendly materials in both residential and commercial applications presents an opportunity for manufacturers to develop and market sustainable ceramic tiles.

Understanding market segmentation by application can provide valuable insights for manufacturers looking to expand their product offerings and increase their market share in the Vietnam ceramic tiles market.

Vietnam ceramic tiles market segmentation by application – Commercial segment

Competitive Landscape

The Vietnam ceramic tiles market is highly competitive with the presence of both domestic and international players. The market is fragmented with several players operating in the market, ranging from small local manufacturers to large multinational companies.

Some of major players in the market include:

- Viglacera

- Lixil Group

- H&R Johnson (Vietnam) Ltd.

- Prime Group Vietnam

- Thanh Thanh Ceramics JSC

- VIBO Group

- Hoang Pottery Co., Ltd.

- Binh Duong Tiles and Bricks Co., Ltd.

- The Orient Joint Stock Commercial Bank

These players account for a significant share of the market due to their strong brand reputation, product portfolio, and distribution network.

In recent years, the market has witnessed increased competition due to the entry of new players, particularly from China. The availability of cheaper Chinese ceramic tiles has led to price competition in the market, making it challenging for local manufacturers to compete.

To remain competitive in the market, manufacturers are focusing on product differentiation and innovation, developing sustainable and eco-friendly ceramic tiles, and expanding their distribution networks. For example, Viglacera has launched a new range of sustainable ceramic tiles made from recycled materials, while Dong Tam has expanded its distribution network to reach more customers.

Furthermore, the adoption of digital technologies such as online sales channels and virtual showrooms has also helped manufacturers to maintain their competitive edge in the market.

On the basis of product differentiation, innovation, and price, Vietnam ceramic market players are highly competitive. Manufacturers are also focusing on developing sustainable ceramic tiles and expanding their distribution networks to remain competitive in the market. Manufacturers are focusing on product differentiation, innovation, and sustainability to remain competitive and to capture a larger share of the market. The entry of new players and the availability of cheaper Chinese ceramic tiles have led to price competition in the market, making it challenging for local manufacturers to compete.

The Vietnam ceramic tiles market is highly competitive

Key Market Players

Viglacera

Viglacera is one of the leading players in the ceramic tiles market in Vietnam. The company was established in 1974 and has since become a major manufacturer of ceramic tiles in Vietnam, with a wide range of products that includes porcelain tiles, glazed ceramic tiles, and sanitary ware.

Viglacera has a strong presence in both domestic and international markets, with exports to more than 40 countries, including the US, Japan, Australia, and Europe. The company has several subsidiaries and affiliates, including Viglacera Tiles JSC, Viglacera Sanitary Ware JSC, Viglacera Trading JSC, and Viglacera Land JSC.

The company has a strong focus on research and development, and has established a Research and Development Institute for Construction Materials to develop new and innovative products. Viglacera also focuses on sustainable production and has implemented several measures to reduce the environmental impact of its operations, such as using renewable energy and reducing waste.

Viglacera has received several awards and certifications for its products and operations, including ISO 9001, ISO 14001, and OHSAS 18001 certifications. The company has also been recognized for its contribution to the development of Vietnam’s ceramic industry, and has received several awards from the government of Vietnam.

Key players in the Vietnam ceramic tiles market

Lixil Group

Lixil Group is another prominent player in the ceramic tiles market in Vietnam. The company is a global leader in building materials and housing equipment, with a wide range of products that includes tiles, faucets, bathroom fittings, and other building materials.

Lixil Group has a strong presence in the Vietnamese market, with a range of products that includes ceramic and porcelain tiles, as well as other building materials such as bathroom fixtures and kitchen sinks. The company’s products are known for their quality, durability, and design, and are widely used in both residential and commercial projects.

The company has a strong focus on sustainability and has implemented several measures to reduce its environmental impact. Lixil Group has set a target to reduce its greenhouse gas emissions by 50% by 2030 and has implemented measures to reduce water consumption, waste, and energy consumption in its operations.

Lixil Group has also established several partnerships and collaborations in Vietnam to strengthen its position in the market. In 2018, the company announced a joint venture with VinGroup, a leading Vietnamese conglomerate, to expand its business in the country. The joint venture, known as Lixil Vietnam, focuses on the production and distribution of building materials, including ceramic tiles.

Key players in the Vietnam ceramic tiles market

H&R Johnson (Vietnam) Ltd.

H&R Johnson (Vietnam) Ltd. is a subsidiary of H&R Johnson India, one of the largest ceramic tile manufacturers in India. The company was established in Vietnam in 2006 and has since become a major player in the ceramic tiles market in the country.

H&R Johnson (Vietnam) Ltd. offers a wide range of ceramic tiles, including ceramic tiles, porcelain tiles, and vitrified tiles. The company’s products are known for their quality, durability, and design, and are widely used in both residential and commercial projects.

The company has a strong focus on research and development, and has established a dedicated Research and Development Center in Vietnam to develop new and innovative products. H&R Johnson (Vietnam) Ltd. also focuses on sustainable production and has implemented several measures to reduce the environmental impact of its operations, such as using renewable energy and reducing waste.

H&R Johnson (Vietnam) Ltd. has a strong distribution network in Vietnam, with a presence in both urban and rural areas. The company has established several showrooms and retail outlets across the country, as well as partnerships with several leading distributors.

In addition, H&R Johnson (Vietnam) Ltd. has received several awards and certifications for its products and operations, including ISO 9001, ISO 14001, and OHSAS 18001 certifications. The company has also been recognized for its contribution to the development of Vietnam’s ceramic industry, and has received several awards from the government of Vietnam.

These key market players have a strong presence in the Vietnam ceramic tiles market and are competing on the basis of product differentiation, innovation, sustainability, and distribution. As the market continues to grow, these players are expected to continue their focus on product development, expanding their distribution networks, and leveraging digital technologies to remain competitive.

Key players in the Vietnam ceramic tiles market

Future of the Market

The future of the Vietnam ceramic tiles market is promising, driven by various factors such as increasing construction activities, the growing trend of sustainable construction, and the expanding real estate sector. According to a report by ResearchAndMarkets, the market is projected to reach USD 7.1 billion by 2027, growing at a CAGR of 6.2% during the forecast period from 2022 to 2027.

One of the key drivers of the future of the Vietnam ceramic tiles market is the growing trend of sustainable construction. Consumers are becoming more aware of the environmental impact of construction materials, and this has led to an increasing demand for eco-friendly materials such as ceramic tiles. Manufacturers are focusing on developing sustainable and eco-friendly ceramic tiles to cater to this growing demand in the market.

Moreover, the expanding real estate sector is expected to drive demand for ceramic tiles in the future. Vietnam has been experiencing rapid urbanization, and this has led to an increase in demand for housing. The real estate sector has been growing, and this presents an opportunity for the ceramic tiles market to expand its customer base.

Additionally, the adoption of digital technologies in the market, such as online sales channels and virtual showrooms, is expected to continue to grow in the future. Manufacturers are leveraging digital technologies to reach out to customers and provide a seamless and convenient shopping experience.

The Vietnam ceramic tiles market is expected to remain highly competitive in the future, with the presence of both domestic and international players. Manufacturers are expected to continue focusing on product differentiation, innovation, sustainability, and expanding their distribution networks to remain competitive in the market.

The future of the Vietnam ceramic tiles market is promising, driven by the growing trend of sustainable construction, expanding real estate sector, and the adoption of digital technologies. The market is expected to witness significant growth in the coming years, and manufacturers are expected to leverage these opportunities to remain competitive in the market.

The Vietnam ceramic tiles market is expected to remain highly competitive

Manufacturers are expected to remain competitive in the market.

Conclusion

The Vietnam ceramic tiles market is poised for significant growth in the coming years, driven by a combination of factors such as an increase in construction activities, the growing demand for home renovation and interior design, and rising disposable income among consumers. Despite challenges such as the high cost of production and the availability of substitutes, the market is expected to benefit from the expanding real estate sector and the trend of sustainable construction.

The residential and commercial segments are the key application areas for ceramic tiles in the market, with growing demand from both segments. Ceramic tile manufacturers are focusing on product differentiation, innovation, and sustainability to remain competitive in the market. In addition, the adoption of digital technologies is helping manufacturers to reach out to customers effectively and maintain business operations during the pandemic.

Furthermore, the government’s stimulus measures to support the real estate and construction sectors are expected to boost demand for ceramic tiles in the market. The trend of sustainable construction is also expected to drive demand for eco-friendly materials such as ceramic tiles.

In conclusion, the Vietnam ceramic tiles market is expected to witness robust growth in the coming years, driven by the expanding construction and real estate sectors, the growing demand for interior design, and the increasing trend of sustainable construction. As manufacturers capitalize on these opportunities and overcome the challenges, the market is expected to witness significant growth and emerge as a key player in the global ceramic tiles market.

FAQs

- What is the size of the Vietnam ceramic tiles market? The Vietnam ceramic tiles market was valued at USD 4.8 billion in 2020.

- What is the expected growth rate of the Vietnam ceramic tiles market? The market is expected to grow at a CAGR of 6.2% during the forecast period (2022-2027).

- What are the key drivers of the Vietnam ceramic tiles market? The key drivers are an increase in construction activities and a rise in disposable income.

- What are the major restraints of the Vietnam ceramic tiles market? The major restraints are the high cost of production and the availability of substitutes.

- Who are the key players in the Vietnam ceramic tiles market? Some of the key players in the market include Viglacera, Lixil Group, and H&R Johnson (Vietnam) Ltd.

Leave a reply